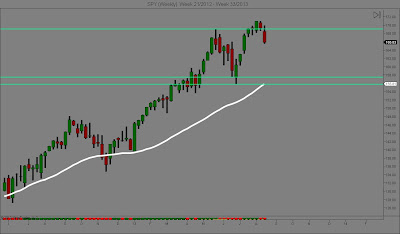

While the long term trend remains up, we are clearly in an intermediate term correction. As you can see from the weekly SPY chart the week closed decidedly down. It now appears to me that not only will price remain range bound, but the probabilities now highly favor a test of the lower green lines. If you have been in the market for some time and haven't already taken off a portion of your position or hedged; now would be the time to do so.

This week I thought I would give you a glimpse of just one of the proprietary indicators that I look at to help me identify high probability intermediate tops in a long term bull market. Take a look at the weekly SPY chart. Now take a look at the indicator in the lower window. Notice that I have drawn gold lines on the indicator whenever it exceeds the upper green line and then starts to form lower highs. Whenever I see this happen I begin looking very closely at the last weekly price bar. If it is particularly bearish, that is confirmation that a high probability intermediate term correction may be in place. I have drawn red down arrows on the weekly price bars the last four times this has happened. Of course, I look to other things like sentiment to give stronger confirmation. I hope you all have a great holiday weekend.

Saturday, August 31, 2013

Saturday, August 24, 2013

WEEKLY MARKET UPDATE

The long term trend remains up. As you can see on the weekly SPY chart the market closed higher this week after selling off earlier in the week. This price action is mildly bullish and the sentiment indicator that I follow suggests a potential short term bottom. However, momentum is still bearish. As I stated last week I feel the probabilities suggest that for the next several weeks price will stay range bound between the high made in May and the lower green lines.

CONCLUSION

In my opinion now is not the time to be establishing a new position if you've been out of the market. I would also certainly be vigilant about hedging or reducing positions if you've been in the market from much lower levels. Have a great weekend.

CONCLUSION

In my opinion now is not the time to be establishing a new position if you've been out of the market. I would also certainly be vigilant about hedging or reducing positions if you've been in the market from much lower levels. Have a great weekend.

Saturday, August 17, 2013

WEEKLY MARKET UPDATE

Last week I stated that if the market were to close on a weekly basis below the high made in May; that the probabilities favored an intermediate term correction. This was based the following observations: 1) Price on a statistical basis was stretched too far above the major moving averages that many institutions follow. 2) Sentiment was beginning to look bearish after being at an historical extreme. As you can see from the weekly SPY chart the market did in fact close lower. In addition, nearly all of the other metrics that I look at to give a high probability confirmation of an intermediate term correction are now in place. Price action and momentum are both negative and sentiment is becoming increasingly bearish.

CONCLUSION

While the long term trend remains intact there is a high probability that price will either continue to decline or simply remain in a trading range somewhere between strong support in the 155 - 158 area and the recent highs made in the 168 - 171 area. At this juncture I would definitely either reduce my position in the market or put at least a partial hedge on to protect gains made thus far.

CONCLUSION

While the long term trend remains intact there is a high probability that price will either continue to decline or simply remain in a trading range somewhere between strong support in the 155 - 158 area and the recent highs made in the 168 - 171 area. At this juncture I would definitely either reduce my position in the market or put at least a partial hedge on to protect gains made thus far.

Friday, August 9, 2013

WEEKLY MARKET UPDATE

The long term trend remains up as does the intermediate term trend. As you can see from the weekly SPY chart, this week closed lower than last week at 169.31...still above the high made in May at 167.78. However, as bullish as things seem this is definitely not the time...IMHO, to establish new positions if you haven't already been fully invested in the market. I say this for two reasons:

1) On a statistical basis the market is extremely overbought compared to the 50 and 200 day moving averages which are widely followed by institutional investors.

2) The sentiment indicator that I place very heavy weighting on is at a historical extreme and is starting to become bearish.

CONCLUSION

If within the next couple of weeks there is a weekly close below 167.78 before any substantial new highs are made, I believe an intermediate term correction is highly probable which has the potential of driving prices down to the 155 - 157.50 levels, which represent the previous all time market highs in 2000 and 2007. While both trends remain up, now is the time in my opinion to start hedging to protect any gains you may have made in this bull market.

1) On a statistical basis the market is extremely overbought compared to the 50 and 200 day moving averages which are widely followed by institutional investors.

2) The sentiment indicator that I place very heavy weighting on is at a historical extreme and is starting to become bearish.

CONCLUSION

If within the next couple of weeks there is a weekly close below 167.78 before any substantial new highs are made, I believe an intermediate term correction is highly probable which has the potential of driving prices down to the 155 - 157.50 levels, which represent the previous all time market highs in 2000 and 2007. While both trends remain up, now is the time in my opinion to start hedging to protect any gains you may have made in this bull market.

Saturday, August 3, 2013

WEEKLY MARKET UPDATE

This update will be short and sweet. As you can see on the weekly SPY chart, the market closed at all time highs for the 2nd time in the last 3 weeks. Both the long term and intermediate term trends are clearly up. Until we get a weekly close below 163.70 (the high made in May) the intermediate term up trend remains intact.

SOMETHING INTERESTING

This past week I was listening to NPR where they were reporting on the economic news. One of the statistics they cited was the improvement in the unemployment rate which now stands at something less than 8%. But the reporter went on to say that of the total available work force, the number of people actually employed today is 4 percentage points less than when Obama first took office. You can play that game with virtually any economic number that comes out, which makes them unreliable for purposes of forecasting trends. But you cannot fudge or shade the direction of interest rates and yields, which have proven to be the most reliable fundamental indicators that I follow when it comes to detecting long term shifts in stock market trends. Have a great weekend!

SOMETHING INTERESTING

This past week I was listening to NPR where they were reporting on the economic news. One of the statistics they cited was the improvement in the unemployment rate which now stands at something less than 8%. But the reporter went on to say that of the total available work force, the number of people actually employed today is 4 percentage points less than when Obama first took office. You can play that game with virtually any economic number that comes out, which makes them unreliable for purposes of forecasting trends. But you cannot fudge or shade the direction of interest rates and yields, which have proven to be the most reliable fundamental indicators that I follow when it comes to detecting long term shifts in stock market trends. Have a great weekend!

Subscribe to:

Comments (Atom)