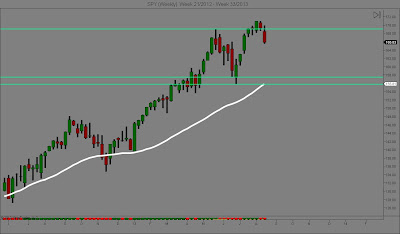

Last week I stated that if the market were to close on a weekly basis below the high made in May; that the probabilities favored an intermediate term correction. This was based the following observations: 1) Price on a statistical basis was stretched too far above the major moving averages that many institutions follow. 2) Sentiment was beginning to look bearish after being at an historical extreme. As you can see from the weekly SPY chart the market did in fact close lower. In addition, nearly all of the other metrics that I look at to give a high probability confirmation of an intermediate term correction are now in place. Price action and momentum are both negative and sentiment is becoming increasingly bearish.

CONCLUSION

While the long term trend remains intact there is a high probability that price will either continue to decline or simply remain in a trading range somewhere between strong support in the 155 - 158 area and the recent highs made in the 168 - 171 area. At this juncture I would definitely either reduce my position in the market or put at least a partial hedge on to protect gains made thus far.

No comments:

Post a Comment