Sorry for the late post this week. I got the blue screen of death (hard drive issues) earlier this past week which set me back a few days. Last week I posted a quarterly chart of the SPY which gave clear evidence of the strength of the long term up trend. This week I thought I would post a monthly chart of the SPY. As you can see this chart also points to a clear distinct up trend. It is analysis of the monthly chart that plays a very important role in confirming long term shifts in trend.

CONCLUSION

Nothing much to add to my commentary of the previous two weeks. The long term and intermediate term up trends remain very much intact. In addition, it is very typical for markets to rally just prior to a holiday. Have a great Thanksgiving.

Sunday, November 24, 2013

Saturday, November 16, 2013

WEEKLY MARKET UPDATE

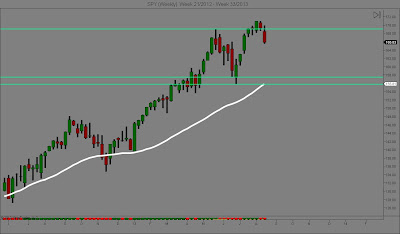

Both the long term and intermediate term trends remain solidly up. For the past several weeks I've been posting a weekly chart of the SPY. The weekly chart is basically the lowest time frame chart I use for determining intermediate term trend strength and for helping to confirm longer term trends. Any lower time frame charts contain too much random movement and IMHO don't give a reliable picture of trend. In fact, even the weekly chart is often too noisy for my taste. Most of my analysis for determining the long term trend and likely intermediate term reversals is done on the monthly and quarterly charts. Today I thought I would post a quarterly chart of the SPY to give you another perspective on the strength of the long term trend. Each bar on this chart represents price movement on a calendar quarter basis. The last currently developing bar is for the period September 1 - November 15. This bar will complete on December 31. As you can see there have now been two consecutive quarters where the market has closed above the previous all time highs in 2000 and 2007.

Saturday, November 9, 2013

WEEKLY MARKET UPDATE

As most of you may be aware on Thursday the market sold off very hard on high volume only to rally nearly as strongly on Friday on high volume. As you can see in the weekly SPY chart the market closed higher than last week. What to make of this? On a daily basis the market has clearly gotten more volatile and choppy but on a weekly basis the market continues to grind higher. On a longer term basis I look at four metrics to confirm trend reversals. One of them is whether the market is overbought (in a rising market) and oversold (in a falling market). The market is CLEARLY overbought right now. But price action is favorable; on a weekly and monthly basis the market continues to make higher highs and lows. Sentiment remains bullish and there are no major resistance levels blocking any further up side advance.

CONCLUSION

The market is still clearly bullish on a long term and intermediate term basis; but is way overbought and due for at least a mild correction. All it would take is for a confluence of other metrics to line up to make this happen. IMHO now would be the time to be cautiously optimistic, increasing exposure to the market only as it proves it can move higher, and be quick to reduce positions when the intermediate term picture becomes bearish.

Saturday, November 2, 2013

WEEKLY MARKET UPDATE

The long term up trend remains very much intact as does the weekly. For the third straight week the SPY closed higher than it's previous all time high made in September. However, as you can see by the latest price bar the market did not make a lot of headway; closing barely higher than where it opened on Monday and just above where the market closed last Friday. If you are a student of Japanese candlestick charts you'll recognize this bar as a "near" doji or indecision bar. Next week's price action will tell us a lot about the future direction of the market on an intermediate term basis. If the market declines below the low of this week's bar the likely direction of the market will be to at least test the highs made in September. If that does happen and the market declines below that level, then the market would likely continue down into the trading range between the upper and lower green lines.

CONCLUSION

By next week's post I will begin posting intermediate term signals as they occur based on my methodology. I should stress that the purpose of this chart should not be whether to decide whether one is 100% in or out of the market; but rather whether or not one may want to consider hedging, increasing or decreasing one's position in the market. The decision to be in or out of the market should be made based primarily on the longer term trend signals. Have a great weekend everyone. GO BLUE!

CONCLUSION

By next week's post I will begin posting intermediate term signals as they occur based on my methodology. I should stress that the purpose of this chart should not be whether to decide whether one is 100% in or out of the market; but rather whether or not one may want to consider hedging, increasing or decreasing one's position in the market. The decision to be in or out of the market should be made based primarily on the longer term trend signals. Have a great weekend everyone. GO BLUE!

Saturday, October 26, 2013

WEEKLY MARKET UPDATE

The bulls stampede on! The week previous the market closed strongly above the all time highs made in September and this past week the market closed even higher. The market has spoken (see weekly SPY chart).

CONCLUSION

I've pointed out in past posts that if on the most recent decline you recently moved most of your 401-K or IRA portfolio into cash; that a prudent strategy would be to slowly dip your toes back into the water, adding more of your portfolio back into the market as it proves it can move higher.

ANNOUNCEMENT

Sometime in November I am going to be adding a feature whereby I will post actual trades based on a few trading strategies I developed based on the broad market indexes and selected individual stocks and ETF's. I am a firm believer that it is not necessary to have one's funds in the market at all times (even if diversified) to significantly outperform the market. My goal is to prove that over the long run. Have a great weekend!

CONCLUSION

I've pointed out in past posts that if on the most recent decline you recently moved most of your 401-K or IRA portfolio into cash; that a prudent strategy would be to slowly dip your toes back into the water, adding more of your portfolio back into the market as it proves it can move higher.

ANNOUNCEMENT

Sometime in November I am going to be adding a feature whereby I will post actual trades based on a few trading strategies I developed based on the broad market indexes and selected individual stocks and ETF's. I am a firm believer that it is not necessary to have one's funds in the market at all times (even if diversified) to significantly outperform the market. My goal is to prove that over the long run. Have a great weekend!

Saturday, October 19, 2013

WEEKLY MARKET UPDATE

Wow, what a strong up week! So much for the news dictating what the market "should" do. Unless you've been living in a cave you no doubt know the shenanigans going on in Washington. Logic would tell you when the news is bad and the threat of another US credit downgrade would cause the market to fall. Instead, the market brushed that off this past week and rallied to all time highs at 174.51 (see weekly spy chart). The market is now above the September high of 173.60 and appears to be headed even higher.

CONCLUSION

As I've stated ad nauseam in prior posts I would still be a bit cautious about going "all in" if you've been 100% out due to overbought nature of the market. However, I do think it's prudent to slowly commit more capital as the market proves it can move higher. This next week is a very critical week as it can either confirm that this week was a true breakout or a false breakout. More on that next week. Be blessed and have a great weekend.

CONCLUSION

As I've stated ad nauseam in prior posts I would still be a bit cautious about going "all in" if you've been 100% out due to overbought nature of the market. However, I do think it's prudent to slowly commit more capital as the market proves it can move higher. This next week is a very critical week as it can either confirm that this week was a true breakout or a false breakout. More on that next week. Be blessed and have a great weekend.

Friday, October 11, 2013

WEEKLY MARKET UPDATE

The long term trend remains up. Just as important, this week the intermediate term trend shifted up as well. Below is a chart of the weekly SPY. On Monday of this past week the market opened lower than where it closed the previous Friday. Early in the week the market sold off but beginning on Wednesday the market started to rally and had a very strong up day on Friday of this week to close above last Friday's close. This is VERY bullish price action and was also confirmed by the sentiment indicator that I look at.

CONCLUSION

Based on this week's price action the high of 173.60 is a high probability target. However, I think that caution is warranted. As bullish as this past week's price action was; the market is still very overextended to the up side. If I were out of the market 100% up until now, I would "dip my toes" back into the market with a small position and then monitor what happens when the September high of 173.60 is reached. Have a great weekend.

CONCLUSION

Based on this week's price action the high of 173.60 is a high probability target. However, I think that caution is warranted. As bullish as this past week's price action was; the market is still very overextended to the up side. If I were out of the market 100% up until now, I would "dip my toes" back into the market with a small position and then monitor what happens when the September high of 173.60 is reached. Have a great weekend.

Friday, October 4, 2013

WEEKLY MARKET UPDATE

The long term trend remains up but the intermediate term outlook remains muddy. On Monday of this week the market opened much lower than where it closed on the previous Friday. While the market closed higher today than where it opened on Monday, it still closed lower than the previous Friday's close.

CONCLUSION

This last week's price action makes it really difficult to tell which direction the market may take on an intermediate term basis. I stand by the position that I've taken in recent weeks until the market can prove it can break out to new highs. By almost every metric I look at the market is overstretched to the up side. I would tend to be more conservative than aggressive at this juncture.

CONCLUSION

This last week's price action makes it really difficult to tell which direction the market may take on an intermediate term basis. I stand by the position that I've taken in recent weeks until the market can prove it can break out to new highs. By almost every metric I look at the market is overstretched to the up side. I would tend to be more conservative than aggressive at this juncture.

Saturday, September 28, 2013

WEEKLY MARKET UPDATE

While the long term trend remains up, the intermediate term picture remains unclear. I stated last week that if this week's price action declined below last week's low, that there would be a high probability of a further decline into one of the support areas below. As you can clearly see on the weekly SPY chart; that happened. The most immediate support level is the August low at 163, then the 40 week moving average at 159.76, then the 156-157.50 level.

CONCLUSION

While anything can happen in the market, after last week's price action, now is not a good time to be establishing a new position in the market if you've been 100% on the sidelines. And IMHO it's a good idea to either scale out of your positions or hedge if you've had most of your investment capital in the market. Have a great weekend!

CONCLUSION

While anything can happen in the market, after last week's price action, now is not a good time to be establishing a new position in the market if you've been 100% on the sidelines. And IMHO it's a good idea to either scale out of your positions or hedge if you've had most of your investment capital in the market. Have a great weekend!

Saturday, September 21, 2013

WEEKLY MARKET UPDATE

This was a very interesting week. While the long term trend remains firmly up, this week's price and volume action indicated a mighty battle between the bulls and the bears. Take a look at the weekly SPY chart. The market opened higher on Monday than where it closed the previous Friday. Early in the week it rallied above the high made in August at 170.97. But later in the week it sold off to close not only lower than the August high, but also lower than where it opened on Monday. Now take a look at the volume this week compared to the two previous weeks. It was much larger. This combination of technical factors tells me that if early next week prices decline below 170 that there is a high probability of a further decline to at least the 163 level; perhaps even lower to the 40 week moving average at 159 or the next lower support level of 155.75 - 157.50.

CONCLUSION

While the long term trend remains up and the last two weeks have rallied strongly, this strikes me as particularly risky time to consider getting back into the market if you have been 100% in cash. I say that not only due to the factors I've already discussed; but when you add the fact that prices are stretched historically high to the up side, the probability of a negative expectancy is higher than a positive expectancy over the intermediate term. Have a great weekend.

CONCLUSION

While the long term trend remains up and the last two weeks have rallied strongly, this strikes me as particularly risky time to consider getting back into the market if you have been 100% in cash. I say that not only due to the factors I've already discussed; but when you add the fact that prices are stretched historically high to the up side, the probability of a negative expectancy is higher than a positive expectancy over the intermediate term. Have a great weekend.

Saturday, September 14, 2013

WEEKLY MARKET UPDATE

The long term trend remains up. As you can see from the weekly SPY chart the week closed up strongly from the previous week. While short term this is bullish I would still call the intermediate term trend undecided or neutral. For the past four months the market has been chopping up and down between the upper and lower green lines.

CONCLUSION

Based on the most recent price action aggressive traders may wish to re-establish buy positions in the anticipation that the market will continue the up trend if it breaks out above the upper green line (August high). Personally, I would not establish any new buys until the market either breaks out above these highs with authority.

CONCLUSION

Based on the most recent price action aggressive traders may wish to re-establish buy positions in the anticipation that the market will continue the up trend if it breaks out above the upper green line (August high). Personally, I would not establish any new buys until the market either breaks out above these highs with authority.

Saturday, September 7, 2013

WEEKLY MARKET UPDATE

The long term trend remains up. As you can see on the weekly SPY chart, the week closed higher than last week but the price action was not particularly convincing. Once again the sentiment indicator that I look at suggests that a short term bottom may be in place. But this is the only indicator that I look at that is pointing to an intermediate term rally. The rest suggest a further decline or that the market remains stuck in between the upper and lower green lines. If you recall last week I showed you an indicator that I use that helps me to identify when the market is "overstretched" to the up side and is due for an intermediate term correction. Note the previous three times these conditions occurred the market corrected at minimum to the 40 week moving average (white line) before resuming the long term trend. In my view it is clear that there is a major battle going on between the bulls and the bears. I still feel there's a better than 50/50 chance the market will decline further towards the 40 week moving average. But anything can happen. I'll keep an eye on things. Have a great weekend.

Saturday, August 31, 2013

WEEKLY MARKET UPDATE

While the long term trend remains up, we are clearly in an intermediate term correction. As you can see from the weekly SPY chart the week closed decidedly down. It now appears to me that not only will price remain range bound, but the probabilities now highly favor a test of the lower green lines. If you have been in the market for some time and haven't already taken off a portion of your position or hedged; now would be the time to do so.

This week I thought I would give you a glimpse of just one of the proprietary indicators that I look at to help me identify high probability intermediate tops in a long term bull market. Take a look at the weekly SPY chart. Now take a look at the indicator in the lower window. Notice that I have drawn gold lines on the indicator whenever it exceeds the upper green line and then starts to form lower highs. Whenever I see this happen I begin looking very closely at the last weekly price bar. If it is particularly bearish, that is confirmation that a high probability intermediate term correction may be in place. I have drawn red down arrows on the weekly price bars the last four times this has happened. Of course, I look to other things like sentiment to give stronger confirmation. I hope you all have a great holiday weekend.

This week I thought I would give you a glimpse of just one of the proprietary indicators that I look at to help me identify high probability intermediate tops in a long term bull market. Take a look at the weekly SPY chart. Now take a look at the indicator in the lower window. Notice that I have drawn gold lines on the indicator whenever it exceeds the upper green line and then starts to form lower highs. Whenever I see this happen I begin looking very closely at the last weekly price bar. If it is particularly bearish, that is confirmation that a high probability intermediate term correction may be in place. I have drawn red down arrows on the weekly price bars the last four times this has happened. Of course, I look to other things like sentiment to give stronger confirmation. I hope you all have a great holiday weekend.

Saturday, August 24, 2013

WEEKLY MARKET UPDATE

The long term trend remains up. As you can see on the weekly SPY chart the market closed higher this week after selling off earlier in the week. This price action is mildly bullish and the sentiment indicator that I follow suggests a potential short term bottom. However, momentum is still bearish. As I stated last week I feel the probabilities suggest that for the next several weeks price will stay range bound between the high made in May and the lower green lines.

CONCLUSION

In my opinion now is not the time to be establishing a new position if you've been out of the market. I would also certainly be vigilant about hedging or reducing positions if you've been in the market from much lower levels. Have a great weekend.

CONCLUSION

In my opinion now is not the time to be establishing a new position if you've been out of the market. I would also certainly be vigilant about hedging or reducing positions if you've been in the market from much lower levels. Have a great weekend.

Saturday, August 17, 2013

WEEKLY MARKET UPDATE

Last week I stated that if the market were to close on a weekly basis below the high made in May; that the probabilities favored an intermediate term correction. This was based the following observations: 1) Price on a statistical basis was stretched too far above the major moving averages that many institutions follow. 2) Sentiment was beginning to look bearish after being at an historical extreme. As you can see from the weekly SPY chart the market did in fact close lower. In addition, nearly all of the other metrics that I look at to give a high probability confirmation of an intermediate term correction are now in place. Price action and momentum are both negative and sentiment is becoming increasingly bearish.

CONCLUSION

While the long term trend remains intact there is a high probability that price will either continue to decline or simply remain in a trading range somewhere between strong support in the 155 - 158 area and the recent highs made in the 168 - 171 area. At this juncture I would definitely either reduce my position in the market or put at least a partial hedge on to protect gains made thus far.

CONCLUSION

While the long term trend remains intact there is a high probability that price will either continue to decline or simply remain in a trading range somewhere between strong support in the 155 - 158 area and the recent highs made in the 168 - 171 area. At this juncture I would definitely either reduce my position in the market or put at least a partial hedge on to protect gains made thus far.

Friday, August 9, 2013

WEEKLY MARKET UPDATE

The long term trend remains up as does the intermediate term trend. As you can see from the weekly SPY chart, this week closed lower than last week at 169.31...still above the high made in May at 167.78. However, as bullish as things seem this is definitely not the time...IMHO, to establish new positions if you haven't already been fully invested in the market. I say this for two reasons:

1) On a statistical basis the market is extremely overbought compared to the 50 and 200 day moving averages which are widely followed by institutional investors.

2) The sentiment indicator that I place very heavy weighting on is at a historical extreme and is starting to become bearish.

CONCLUSION

If within the next couple of weeks there is a weekly close below 167.78 before any substantial new highs are made, I believe an intermediate term correction is highly probable which has the potential of driving prices down to the 155 - 157.50 levels, which represent the previous all time market highs in 2000 and 2007. While both trends remain up, now is the time in my opinion to start hedging to protect any gains you may have made in this bull market.

1) On a statistical basis the market is extremely overbought compared to the 50 and 200 day moving averages which are widely followed by institutional investors.

2) The sentiment indicator that I place very heavy weighting on is at a historical extreme and is starting to become bearish.

CONCLUSION

If within the next couple of weeks there is a weekly close below 167.78 before any substantial new highs are made, I believe an intermediate term correction is highly probable which has the potential of driving prices down to the 155 - 157.50 levels, which represent the previous all time market highs in 2000 and 2007. While both trends remain up, now is the time in my opinion to start hedging to protect any gains you may have made in this bull market.

Saturday, August 3, 2013

WEEKLY MARKET UPDATE

This update will be short and sweet. As you can see on the weekly SPY chart, the market closed at all time highs for the 2nd time in the last 3 weeks. Both the long term and intermediate term trends are clearly up. Until we get a weekly close below 163.70 (the high made in May) the intermediate term up trend remains intact.

SOMETHING INTERESTING

This past week I was listening to NPR where they were reporting on the economic news. One of the statistics they cited was the improvement in the unemployment rate which now stands at something less than 8%. But the reporter went on to say that of the total available work force, the number of people actually employed today is 4 percentage points less than when Obama first took office. You can play that game with virtually any economic number that comes out, which makes them unreliable for purposes of forecasting trends. But you cannot fudge or shade the direction of interest rates and yields, which have proven to be the most reliable fundamental indicators that I follow when it comes to detecting long term shifts in stock market trends. Have a great weekend!

SOMETHING INTERESTING

This past week I was listening to NPR where they were reporting on the economic news. One of the statistics they cited was the improvement in the unemployment rate which now stands at something less than 8%. But the reporter went on to say that of the total available work force, the number of people actually employed today is 4 percentage points less than when Obama first took office. You can play that game with virtually any economic number that comes out, which makes them unreliable for purposes of forecasting trends. But you cannot fudge or shade the direction of interest rates and yields, which have proven to be the most reliable fundamental indicators that I follow when it comes to detecting long term shifts in stock market trends. Have a great weekend!

Friday, July 26, 2013

WEEKLY MARKET UPDATE

Both the long term and intermediate term trends remain up. This past week the market opened slightly higher than where it closed the previous week and closed slightly lower. For you who are familiar with candlestick patterns this past week indicated indecision. In my opinion what happens next week will be critical in determining whether the intermediate term trends remains up or shifts down. If next week closes above 169.86 the intermediate term up trend is confirmed and a further move up is highly probable. If the market closes below 167.52 the intermediate term trend will shift down and a move down to the lower green lines is a distinct possibility.

Have a great weekend!

Have a great weekend!

Saturday, July 20, 2013

WEEKLY MARKET UPDATE

As you can see from the weekly SPY chart the market closed higher for the fourth consecutive week. Both the long and intermediate term trends remain up. What is interesting though; is if you look closely at the price bar, the range (high minus low) of the bar is the lowest of the last four weeks and it closed right near the high of 169.07 made in May. Any of you who may be familiar with price patterns will also note that there is a potential double top setting up. If the market closes particularly bearish next week, the probabilities strongly favor that the market will decline further over the intermediate term, with the potential to either test the lower green lines or just remain trading in a range between the lower green lines and the upper green line.

CONCLUSION

In a few recent posts I've had articles regarding hedging. This is a time when I would consider at least putting on a partial hedge. The market has made quite a move and is now challenging a major resistance level at 169.07. If the market were to close very bearishly next week, then I would consider putting on a full hedge. Have a great weekend.

Saturday, July 13, 2013

WEEKLY MARKET UPDATE

The long term trend remains up and for the third consecutive week there was a higher close. More importantly the price range of last week was very bullish. The market is only a couple of points away from the all time high in SPY made in May. Last week I opined that it was likely that we may see the market bounce around for a while between the upper and lower green lines. That opinion has not changed. Let's see what happens over the next week or two.

WHAT ABOUT THE FUNDAMENTALS?

On occasion I am asked if my analysis is heavily dependent on news or fundamental data. The short answer is no. Believe me I have charted a lot of fundamental data series against charts of the SPY and the only two things I have found useful is the Federal Funds Rate and the yield for 1 year treasury notes. As you may or may not know the stock market is very sensitive to the actions of the federal reserve, particularly as it relates to interest rates. In simplest terms if the Fed is raising interest rates during a rising stock market, eventually yields on other investments (like treasury notes) start becoming more attractive. On the other hand when the Fed starts lowering rates during a falling stock market, this eventually translates to lower yields on other investments and investors start looking back to the stock market. Take a look at a monthly SPY chart below. In the top pane is the SPY, in the next pane I've charted the Federal Funds Rate and in the bottom pane the 1 year Treasury Note Yield. Now take a look at the blue lines drawn on both as you compare to the price of the SPY. You should note that it wasn't too long after both series rose above 5% that the bear markets of 2001 and 2008 began. Conversely, the stock market bottomed in late 2002 and in 2009 not long after both series declined below 2%.

CONCLUSION

I have some ideas for future posts but I would really like to get some feedback from my readers. If you have anything you would like to see I am interested. I hope you all have a great weekend.

WHAT ABOUT THE FUNDAMENTALS?

On occasion I am asked if my analysis is heavily dependent on news or fundamental data. The short answer is no. Believe me I have charted a lot of fundamental data series against charts of the SPY and the only two things I have found useful is the Federal Funds Rate and the yield for 1 year treasury notes. As you may or may not know the stock market is very sensitive to the actions of the federal reserve, particularly as it relates to interest rates. In simplest terms if the Fed is raising interest rates during a rising stock market, eventually yields on other investments (like treasury notes) start becoming more attractive. On the other hand when the Fed starts lowering rates during a falling stock market, this eventually translates to lower yields on other investments and investors start looking back to the stock market. Take a look at a monthly SPY chart below. In the top pane is the SPY, in the next pane I've charted the Federal Funds Rate and in the bottom pane the 1 year Treasury Note Yield. Now take a look at the blue lines drawn on both as you compare to the price of the SPY. You should note that it wasn't too long after both series rose above 5% that the bear markets of 2001 and 2008 began. Conversely, the stock market bottomed in late 2002 and in 2009 not long after both series declined below 2%.

CONCLUSION

I have some ideas for future posts but I would really like to get some feedback from my readers. If you have anything you would like to see I am interested. I hope you all have a great weekend.

Saturday, July 6, 2013

WEEKLY MARKET UPDATE

The long term trend remains up. This week the market closed higher than the previous week so the intermediate term trend is pointing back up. Last week I said that if there was a strong weekly higher close I would be more convicted that the high made in May (upper green line) would be retested. Although we got a higher close, it was not a particularly bullish close. However, it was a shorter week due to the holiday. The lower green lines remain strong support and the upper green line strong resistance. Based on recent price action I think that there is a strong likelihood that we may just see the market bounce around between these levels. But for now, both trends are pointing up.

HEDGING

As I stated

last week the primary objection to hedging is the cost. I also went on to say that over the long run

an investor who prudently hedges will come out ahead. So what does prudently hedge mean? Simply, you want to keep the cost of hedging

as low as possible so you can enjoy similar returns to the investor who does

not hedge when the market is rallying strongly while at the same time strictly

defining your risk when the major market correction does come. My model or blueprint of how to do this is as

follows:

1) When an intermediate term buy signal

is given I begin selling covered calls against the underlying. Each month I will sell calls above the

current price of the market. I choose a

strike price at about a 30 delta. I will

sell calls at about a 50% ratio to the stock.

What this means is if I own 200 shares of the SPY I begin selling calls. I will sell only one SPY call (equivalent of

100 shares of SPY ). The primary objective is to

accumulate cash in my account to either largely reduce or in some cases entire

pay for the cost to hedge when that time comes.

2) Hedge only when you need to. I use an intermediate term timing

model/system to help me do this. I typically

would buy ¼ to ½ the number of puts I need when the model/system tells me that

the market has moved too far in an up trend and is likely to have a larger than

normal correction. I buy the other ½ - ¾ when an intermediate term sell signal is

given.

CONCLUSION

I should

point out that selling calls as described above is only workable outside of a

401-K. If most of your funds are in a

401-K, you wouldn’t be able to enjoy the benefit of using call premium to pay for your

hedge. But you would still keep the cost of hedging low by using a good intermediate term

timing model/system to tell you the optimum time to put on the hedge.

Saturday, June 29, 2013

WEEKLY MARKET UPDATE

The long term trend remains up. Last week I stated that the first likely area of support was the 157.50 level which represented the October 2007 high. What is interesting is that the market not only traded down to this level but it also traded just two ticks below the March 2001 high at 155.75 (lowest green line) just before rallying for most of the week to close higher than the previous week and more importantly, above these two important support levels. Ordinarily I would consider this to be very bullish but when looking at this week's price action compared to previous week, the rally was not very strong. At this juncture I would say there's a 50-50 chance that this past week was just a week rally in an intermediate term down trend. If we get a weekly close below the lowest green line, then the 40 week moving average is the next support target at 151.38. If we get a strong weekly up close then there is a strong probability that the May 2013 high of 169.07 is challenged.

CONCLUSION

I will continue my series of articles on hedging next week. I was unable to put anything together this week due to time constraints. Next week I will talk about how to lower the cost of hedging and provide a general blueprint of when to hedge. Have a great weekend!

CONCLUSION

I will continue my series of articles on hedging next week. I was unable to put anything together this week due to time constraints. Next week I will talk about how to lower the cost of hedging and provide a general blueprint of when to hedge. Have a great weekend!

Saturday, June 22, 2013

WEEKLY MARKET UPDATE

While the long term trend remains intact, the intermediate term trend is pointing down. As I pointed out last week, the next likely area of support is the October 2007 high which is represented by the lower green line (see weekly SPY chart). If the market manages to close strongly below that level on a weekly basis, then the 40 week moving average is a likely target at the 151 level.

HEDGING

In last week's post I answered the question of what type of put option to buy as well as how many to buy to properly hedge a portfolio. This week I want to talk about what strike price to buy and how far out in time one should go:

1) What strike price to buy? ANSWER: This is really a function of your risk tolerance and how much you're willing to spend. Two weeks ago I showed you an example of buying a put option with a strike price very close to the current price of the SPY (at-the-money put). Buying this put limited my maximum downside loss to only 5.9%. I could have chosen a put at a lower strike price (out-of-the-money put) which would have costed less, but then my maximum downside loss would be greater than 5.9%. What you need to know is that there is a trade off between cost and risk. If you want to cap your loss at 5%, you're going to have to pay more. However, if you have a greater risk tolerance; say 10%...then you can spend less on an out-of-the-money option.

2) How much time to buy? ANSWER: During long term bull markets major corrections may last anywhere from 1 - 6 months. However, if you look closely at the charts most of the damage is typically done within 3 months. Personally, one month of protection is not enough for me, but I think it's unnecessary to spend more than I have to. For this reason I typically prefer 3 months. But again, the more time you buy, the more you're going to pay.

CONCLUSION

Obviously there is a cost associated with hedging a portfolio. So over the short to intermediate term an investor who does not hedge may enjoy better returns. But the fact of the matter is that over the long run there are significant corrections. There is no question in my mind that results of an investor who does prudently hedge will outperform over the long run. For those of you who are still hung up on cost; what if there was an option strategy that you could employ that would not only help pay for the put option while still allowing unlimited profit potential? I'll get into more detail in future posts. Enjoy your weekend!

HEDGING

In last week's post I answered the question of what type of put option to buy as well as how many to buy to properly hedge a portfolio. This week I want to talk about what strike price to buy and how far out in time one should go:

1) What strike price to buy? ANSWER: This is really a function of your risk tolerance and how much you're willing to spend. Two weeks ago I showed you an example of buying a put option with a strike price very close to the current price of the SPY (at-the-money put). Buying this put limited my maximum downside loss to only 5.9%. I could have chosen a put at a lower strike price (out-of-the-money put) which would have costed less, but then my maximum downside loss would be greater than 5.9%. What you need to know is that there is a trade off between cost and risk. If you want to cap your loss at 5%, you're going to have to pay more. However, if you have a greater risk tolerance; say 10%...then you can spend less on an out-of-the-money option.

2) How much time to buy? ANSWER: During long term bull markets major corrections may last anywhere from 1 - 6 months. However, if you look closely at the charts most of the damage is typically done within 3 months. Personally, one month of protection is not enough for me, but I think it's unnecessary to spend more than I have to. For this reason I typically prefer 3 months. But again, the more time you buy, the more you're going to pay.

CONCLUSION

Obviously there is a cost associated with hedging a portfolio. So over the short to intermediate term an investor who does not hedge may enjoy better returns. But the fact of the matter is that over the long run there are significant corrections. There is no question in my mind that results of an investor who does prudently hedge will outperform over the long run. For those of you who are still hung up on cost; what if there was an option strategy that you could employ that would not only help pay for the put option while still allowing unlimited profit potential? I'll get into more detail in future posts. Enjoy your weekend!

Saturday, June 15, 2013

WEEKLY MARKET UPDATE

The long term trend remains up. However, as I've pointed out in my last two posts, a high probability exists for an intermediate term correction, especially after last week's price action (see SPY chart). As you can see the market opened higher than the previous week only to close lower than where it closed the previous week. This is very bearish price action. If the SPY next week closes below 162 the probabilities are very high that the market will correct at minimum to the 157.50 (lower green line) which represents the previous all time high made in the SPY in October, 2007. If the market continues to correct below that level, a test of the 40 week moving average (white line) currently at 150.72 is likely.

This market is long in the tooth and overdue for at least an intermediate term correction. As I mentioned last week, If you have been long from a much lower levels it may be wise to take some profits off the table or look at potentially hedging by buying put options.

HEDGING

In last week's post I illustrated a simple yet powerful hedge technique which involved buying simple put options to hedge a portfolio with stocks, ETF's or mutual funds. Many of you may be thinking great, but I have the following questions:

1) What kind of puts do I buy to provide an adequate hedge? ANSWER: The puts should be related to an ETF which is most closely related to your portfolio. If your portfolio is most heavily weighted with blue chip companies, consider buying put options on the DIA. If mostly technology stocks, consider the QQQQ. If mostly large cap stocks, then consider the SPY.

2) How many puts do I buy to provide an adequate hedge? ANSWER: The formula for determining how many puts to buy is simple. You simply take the value of your portfolio divided by (the current ETF price X 100). As an example, let's say today your portfolio value is $100,000 and it is most closely correlated to the SPY. Friday's SPY close was 163.18. Following is the calculation for the number of puts you need:

$100,000 divided by (163.18 X 100) = 6.12....or 6 SPY puts.

CONCLUSION: Next week I'll get more into what strike price one may consider purchasing as well as how much time to buy. In future posts I'll talk more about when one may consider putting on and taking off a hedge as well as ways to lower the costs of hedging.

This market is long in the tooth and overdue for at least an intermediate term correction. As I mentioned last week, If you have been long from a much lower levels it may be wise to take some profits off the table or look at potentially hedging by buying put options.

HEDGING

In last week's post I illustrated a simple yet powerful hedge technique which involved buying simple put options to hedge a portfolio with stocks, ETF's or mutual funds. Many of you may be thinking great, but I have the following questions:

1) What kind of puts do I buy to provide an adequate hedge? ANSWER: The puts should be related to an ETF which is most closely related to your portfolio. If your portfolio is most heavily weighted with blue chip companies, consider buying put options on the DIA. If mostly technology stocks, consider the QQQQ. If mostly large cap stocks, then consider the SPY.

2) How many puts do I buy to provide an adequate hedge? ANSWER: The formula for determining how many puts to buy is simple. You simply take the value of your portfolio divided by (the current ETF price X 100). As an example, let's say today your portfolio value is $100,000 and it is most closely correlated to the SPY. Friday's SPY close was 163.18. Following is the calculation for the number of puts you need:

$100,000 divided by (163.18 X 100) = 6.12....or 6 SPY puts.

CONCLUSION: Next week I'll get more into what strike price one may consider purchasing as well as how much time to buy. In future posts I'll talk more about when one may consider putting on and taking off a hedge as well as ways to lower the costs of hedging.

Saturday, June 8, 2013

WEEKLY MARKET UPDATE

The long term trend remains up. Last week I pointed out that the probabilities favored a weekly correction that could perhaps result in a decline to the 157.50 area, which represents the October, 2007 high or could potentially drop all the way to the 40 week moving average at 150.24. While the week started off with a decline, it rallied to close higher on Friday than where it opened on Monday. This latest weekly bar is slightly bullish. I still believe that the probabilities favor a market correction but last week's price action indicates that there is the potential that the May high of 169.07 may be tested first.

BENEFIT OF HEDGING

A bull market never moves up in a straight line. There are minor and major corrections along the way which could severely impact account equity. A minor correction of 5% would not be difficult to recover from but at a 10% loss you need an 11.1% return to get back to break even. A 20% loss you need a 25% return to get back to break even. Things start getting progressively worse once you lose 30% or more.

What if you could employ a simple hedging strategy where you could dictate exactly how much you're willing to lose, even if you stayed 100% invested during a market crash or long term bear market? Today I'm going to show you a brief illustration of how buying a simple put for protection could have benefited you during the most recent major market correction where the market lost 15.7% from 5/3/2011 to 10/5/2011. Let's compare the results of Investor A vs. Investor B during this time frame. Both decide to purchase 100 shares of the SPY at 135.73 on 5/3/2011. Investor A simply decides to buy and hold but Investor B decides to hedge his position by buying the a December 2011 put option at the 135 strike. Following are their investment results as of 10/5/2011:

Investor A initial equity is $13,573 (100 shares * 135.73). The value of his investment on 10/5/2011 is now $11,442 (100 shares * 114.42). His equity during this decline has lost 15.7%.

Investor B initial equity is also $13,573. Like Investor A; his stock equity is also $11,442 as of 10/5/2011. However, the put option that he paid $835 for on 5/3/2011 is worth $2,170 on 10/5/2011. His total equity is now $12,777 which represents the stock equity minus the cost of the put plus the current value of the put (11,442 - 835 + 2,170). His equity during this decline has lost only 5.9%.

CONCLUSION

This week I've only shown a basic example of hedging. But as you can see even a simple hedge can provide you with significant protection during severe market declines. In the weeks to follow I plan on addressing how one might hedge a 401-K plan as well as IRA's. Have a great weekend.

BENEFIT OF HEDGING

A bull market never moves up in a straight line. There are minor and major corrections along the way which could severely impact account equity. A minor correction of 5% would not be difficult to recover from but at a 10% loss you need an 11.1% return to get back to break even. A 20% loss you need a 25% return to get back to break even. Things start getting progressively worse once you lose 30% or more.

What if you could employ a simple hedging strategy where you could dictate exactly how much you're willing to lose, even if you stayed 100% invested during a market crash or long term bear market? Today I'm going to show you a brief illustration of how buying a simple put for protection could have benefited you during the most recent major market correction where the market lost 15.7% from 5/3/2011 to 10/5/2011. Let's compare the results of Investor A vs. Investor B during this time frame. Both decide to purchase 100 shares of the SPY at 135.73 on 5/3/2011. Investor A simply decides to buy and hold but Investor B decides to hedge his position by buying the a December 2011 put option at the 135 strike. Following are their investment results as of 10/5/2011:

Investor A initial equity is $13,573 (100 shares * 135.73). The value of his investment on 10/5/2011 is now $11,442 (100 shares * 114.42). His equity during this decline has lost 15.7%.

Investor B initial equity is also $13,573. Like Investor A; his stock equity is also $11,442 as of 10/5/2011. However, the put option that he paid $835 for on 5/3/2011 is worth $2,170 on 10/5/2011. His total equity is now $12,777 which represents the stock equity minus the cost of the put plus the current value of the put (11,442 - 835 + 2,170). His equity during this decline has lost only 5.9%.

CONCLUSION

This week I've only shown a basic example of hedging. But as you can see even a simple hedge can provide you with significant protection during severe market declines. In the weeks to follow I plan on addressing how one might hedge a 401-K plan as well as IRA's. Have a great weekend.

Saturday, June 1, 2013

WEEKLY MARKET UPDATE

On a long term basis the market is still very much in an up trend based on the four factors I pointed out in last week's post. As I also pointed out last week there will be several weeks where little comment is necessary on the long term signals since they are so infrequent. Therefore, for the most part the weekly updates will be focused on identifying high probability intermediate term market corrections.

If one is fully invested in mutual funds in a 401-K or IRA, there are two things you may want to consider. 1) Based on your risk tolerance move a desired percentage into cash. 2) Consider hedging your position with put options. In next week's post I'll start getting into more detail about basic hedge techniques that can be used to allow one to stay fully invested during longer term up trends while significantly reducing the portfolio drawdown during intermediate term market corrections. Have a great weekend!

The tools that I use for this purpose are the weekly SPY chart with a 40 week moving average (see attached). I also use the same sentiment indicator (not shown on chart) that I use for determining the longer term signals. As of the close of this past week my analysis points to a high probability of a market correction with potential support targets of 157.52 (October 2007 high) with a potential for the market to drop all the way to the 40 week moving average (white line) at 149.65. Following is the analysis:

1) The market is trading at a level above the 40 week moving average which is historically related to significant market corrections.

2) If any of you are familiar with japanese candlestick analysis; last week was a doji bar which closed lower and this week closed lower with a bearish engulfing bar.

3) Sentiment (not shown) is rising from historically low levels.

Saturday, May 25, 2013

INTRODUCTION TO NEW BLOG

For the past 20 years I have

been a student of the stock market. For

the last 10 years or so in particular it has been my passion and focus to

develop an accurate, robust long term timing method; the primary purpose being

to help individuals decide when they may want to be invested in stocks or

mutual funds in their retirement plan and when to exit or move 100% into

cash. If a method like this exists, the

value cannot be overstated. I have spoken

to countless individuals whose retirement plans were decimated in the last two

major bear markets. Many are just seeing

their equity recover back to the same level as in early 2000. What if they had the aid of a good long term

timing method to help them avoid these gut wrenching losses? What would their results be today?

I am happy to say that I have

developed an accurate, robust long term timing method which has been back

tested over several decades of data.

This model is NOT simply a computer algorithm which spits out mechanical

buy and sell signals but is rather a rule based approach based on decades of

experience looking at price charts and the most important indicators that

confirm long term trend changes. Without

getting into too much detail following are the factors that I look at to determine

the buy and exit signals:

1) Price and momentum analysis of Quarterly chart.

2) Analysis of price swings based on daily price data.

3) Analysis of significant support and resistance levels.

4) Analysis of sentiment.

Below is the most recent

quarterly chart of the SPY showing the historical buy and exit signals.As you can see the method had only one losing

signal but more importantly never missed a major buy signal AND had you out of

the market well before the major drops occurred.

Although I will update the blog weekly (typically Saturday morning), there may not be much commentary as the buy and exit signals are infrequent. In future posts I’ll get more into hedging techniques that can be very useful during intermediate term corrections during a bull market. If you have any questions or suggestions, please send me an email. Have a great holiday weekend!

Subscribe to:

Comments (Atom)